As of the 1st November 2018, the Australian Financial Complaints Authority (AFCA) will be the new external dispute resolution scheme for financial services consumers, replacing the Financial Ombudsman Service (FOS).

AFCA replaces three existing EDR schemes of the Financial Ombudsman Service (FOS), the Credit and Investments Ombudsman (CIO) and Superannuation Complaints Tribunal (SCT) so that consumers have access to a single EDR scheme.

Midland, in accordance with the requirements of the first phase of this change, have become an AFCA member and updated all documentation and the website as required.

We are committed to servicing our customers and are always open to feedback. In the event you are dissatisfied with our services, we aim to resolve any problem as quickly as possible.

Clients not satisfied with our services should contact our Complaints Officer. In addition to AFCA we also adopt the Insurance Broker Code of Practice (2014). Further information is available from our office or contact AFCA directly on 1800 931 678 or visit afca.org.au

If you have any questions, please don't hesitate to contact your local Midland office.

A Guide for Building Owners and Owner's Corporations

[/fusion_text][fusion_text]The introduction of major legislative changes to combat the fire risk of cladding may affect your building.

To help you understand the changes and what they mean to you, we have summarised the details for the states affected so far – NSW, Victoria and Queensland.

Insurance Considerations

The presence of Aluminium Composite Panel (ACP) or other types of cladding is substantial to the insurance contract and must be disclosed.

Disclosure of ACP can influence the insurance premium and excess structure for a policy due to the heightened associated risk exposure.

Midland Insurance Brokers are specialists in business insurance and have continued to support the strata industry by offering solutions to buildings with ACP.

Contact your broker to discuss how we can help you with these changes.

Contact Us

NSW

Building product use ban on any ACP with a core comprising of greater than 30% polyethylene. If the owners corporation receive a rectification order relating to banned ACP, the ACP may have to be removed and/or replaced.

Owners are required to register their buildings with the NSW Government through an online portal if they have external combustible cladding.

The ban is retrospective. Therefore, if an Owners Corporation’s building has ACP that is now banned, it automatically becomes an “Affected building.”

It is the Owners Corporations’ responsibility to ensure the work is carried out, regardless of the solution required in order to comply.

If a rectification order of ‘affected building’ notice has been received, this must be disclosed I any contract of sale. And any notices/orders received must be disclosed to an owner and mortgagee of a lot.

What action should an Owners Corporation take to comply?

- Review all specifications, plans and building documents to ascertain if they have external cladding which is now considered a banned product.

- Engage a fire safety professional to inspect the building and if banned ACP is present, determine what course of action is next. The fire safety professional will also be able to advise whether you have any other forms of cladding or cladding systems that will need to be registered through the government online portal.

- Once the NSW Government online portal is operational, ensure your building is registered in order to comply with new Regulations.

VIC

Legislation recently passed that allows owners corporations to enter into a Cladding Rectification Agreement (CRA) with Local Council, with the view to funding removal of combustible cladding through low interest loans through Council Rates.

The Victorian Building Authority is leading a state-wide audit of: apartment complexes, motels and hotels (three storeys and above); buildings where Victorians gather as a large group, such as sporting arenas, and; schools, private hospitals or aged-care facilities (two storeys and above).

What action should an Owners Corporation take to comply?

Regardless of what materials are used on your building, now is a good time to review the fire safety features and procedures for your building.

Confirm no material changes have been made (such as a facade upgrade) to the exterior of the building or the balconies, that may compromise fire safety or a fire safety assessment conducted prior to the works being performed.

If the Owners Corporation has received a Building Notice it will denote that the external walls of the building consist of combustible materials and there is an unacceptable level of danger to life. As an Owners Corporation you are now required to ‘SHOW CAUSE’ why occupation of the building should not be prohibited or why you should not replace all combustible materials and or carry out other items denoted in the notice or order.

A registered Fire Engineer and/or Building Practitioners may assist and guide you through this period by:

- Obtaining an extension of time for your Owners Corporation to ‘SHOW CAUSE’

- Working with stakeholders to prepare a response to the ‘SHOW CAUSE’ requirements.

- Conducting a Fire Engineering Review - This process can save considerable funds on rectification works, rather than just replacing all the combustible materials, which could cost millions of dollars. For this to occur, a Fire Engineering Brief and Fire Engineering Report will need to be completed.

QLD

The Queensland Government has recently amended the Building Regulation 2006 (Building and Other Legislation Cladding Amendment Regulation 2018).

Safety Building has been established by the QLD Government to help identify buildings in Queensland that may have potentially combustible cladding.

The change in legislation means that some Body Corporates may be required to register their buildings and complete the combustible cladding checklist.

What action should an Owners Corporation take to comply?

All Body Corporates with buildings that are three or more levels and are built or renovated after 1st January 1994, will need to submit a Statutory declaration to the QLD Government confirming whether their buildings have any ACP cladding attached.

If the Body Corporate is unsure about any ACP being present, they will need to engage an industry professional to determine this.

For buildings that have established the existence of non-conforming cladding, the Body Corporate must:

- Display a notice to that effect in an easily visible part of the building for so long as the cladding remains in place; and

- Every lot owner and long term tenant must be given a copy of that notice – including new tenants and new owners.

If the Body Corporate fails to comply with any lodgement dates, by default they are automatically advanced into compliance with the next stage, which is more onerous for Body Corporates and more expense. If the Body Corporate ultimately fails to lodge documents they will face substantial fines

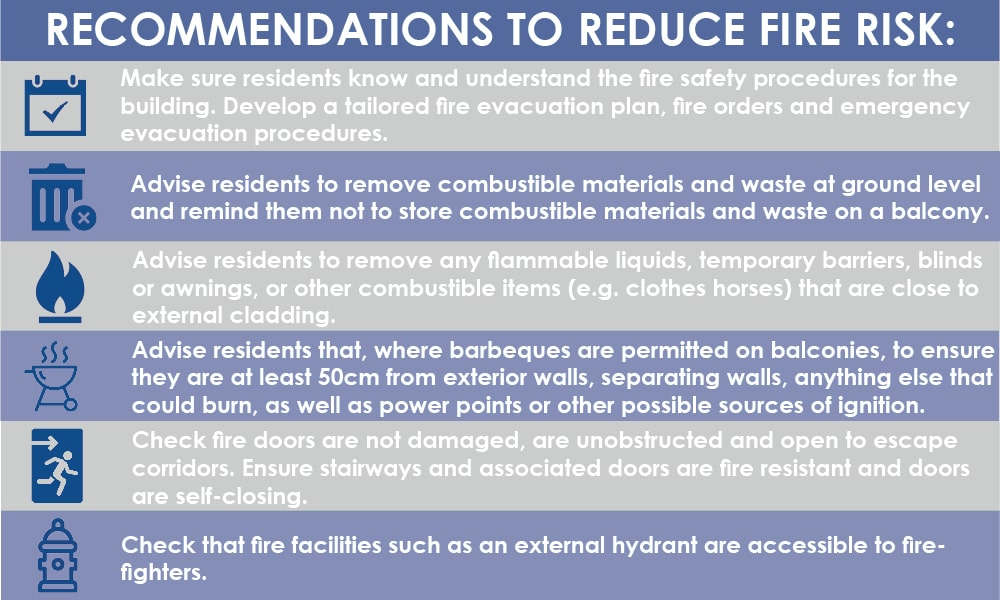

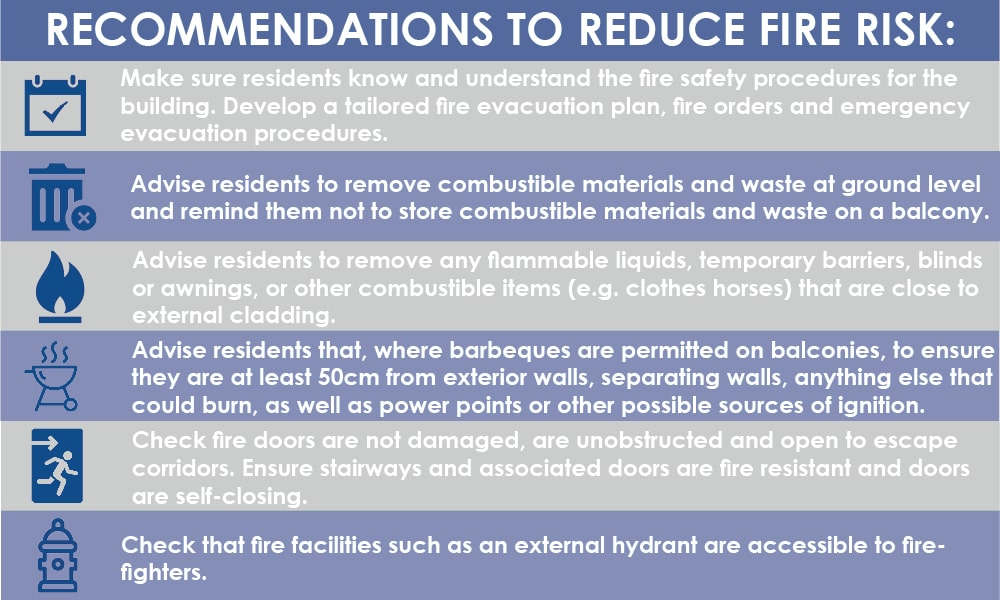

It is recommended that building owners, owners’ corporations and facilities managers undertake the following fire safety actions to reduce fire risk:

Any advice is general in nature and does not take account of your personal objectives, financial situation and needs. Read the relevant Product Disclosure Statement before acquiring any products mentioned.