KEY TAKEAWAYS

- Parametric insurance is based on a ‘triggered’ event rather than a claim for actual harm or loss. It’s an insurance alternative that’s good for the customer and it looks like it’s here to stay. It basically covers the probability of a predefined event happening and pays out an agreed amount instead of compensating for the actual loss incurred. Claims are settled quickly, the payout is certain, and it allows the customer to plan ahead.

- Although still in its infancy in Australia, it is likely to show strong growth over the coming years as triggers can be better defined, especially as AI and robotics allow technology to make decisions, replicate human actions at scale and with precision.

- The future of parametric cover could see it applied across a wide range of industries and events, including agriculture, tourism & travel, retail, shipping, natural landmarks impacted by climate change, terrorism and even brand sentiment.

What is Parametric Insurance?

Parametric insurance is growing at a rapid pace around the world and is being praised as an attractive alternative to some traditional insurance policies.

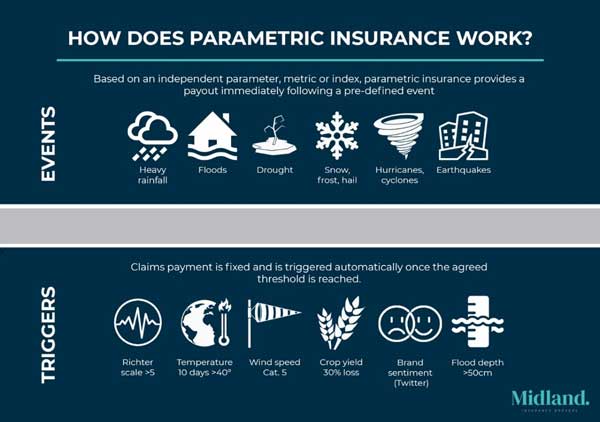

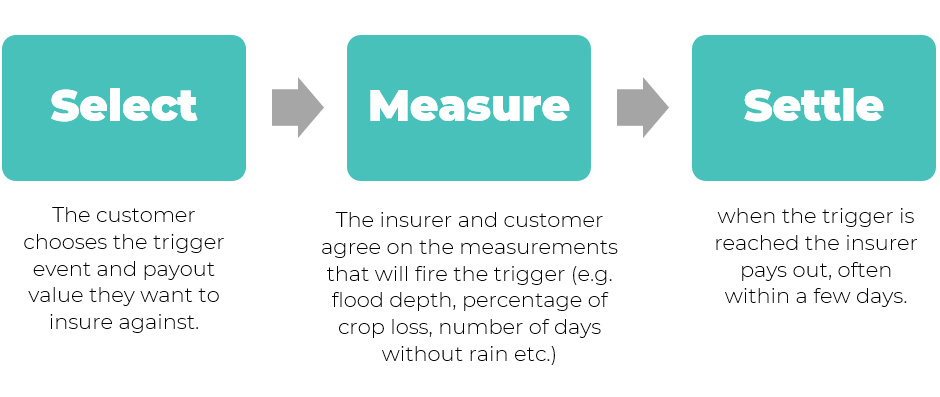

Even if it does sound a little complex, parametric insurance (or event-based insurance) is simpler than traditional cover. Compared to a typical insurance claim which compensates for harm or loss, parametric insurance pays out a pre-agreed amount based on a ‘triggered’ event using objective data sets that neither the insurer nor client controls.

“Global parametric premiums have reached $US5 billion and are growing by 6-9% every year”.

When could parametric insurance be used?

Natural catastrophes or extreme weather events are currently the most prominent triggers as they can be defined by magnitude (e.g. earthquakes, tropical cyclones, floods), or wind speed or precipitation metrics. However, there are also other applications where payouts can be calculated using robust data points, including triggers for market indices, power outages, crop yields or even online sentiment for insuring a brand’s value.

How does parametric insurance work?

Below are a few case studies of how parametric insurance has been implemented throughout the world, followed by a couple of opportunities closer to home that we could potentially see put in place.

Case Studies

Case study 1: global insurance company, CelsiusPro, worked with the Ethiopian government to cover 15 regions and 6,500 farmers across the country with parametric insurance, so that in the event of a drought the farmers get paid out by the government. (Source: ABC News)

Case study 2: an owner of an open-pit salt mine in northern Australia was required to evacuate the site in the probable event of a cyclone. As a result, the owner had to undertake costly and time-consuming geotechnical studies before operations could resume. To address the problem, a parametric product was offered which would pay out in the event of a tropical strength cyclone. The payout would be triggered if the cyclone fell within 100 kilometres of the mine. (Source: qic.com.au)

Case study 3: In January 2019, Swiss Reinsurance Co. launched FLOW, a parametric water-level insurance product designed to protect companies from the financial impact of high or low river water levels. The direct physical effects of low water levels are almost non-existent, but the indirect costs to businesses that depend on rivers can be significant. (Source: Corporate Solutions Swiss)

Opportunities

Opportunity 1: after the expensive drought bail-outs of 2014 and 2018 in Australia, and the effects of climate change likely to bring more droughts in the years to come, parametric insurance within the agricultural industry is being taken a lot more seriously. With the addition of hundreds of new meteorological stations over the past decade and the rapid advancement in technology, farmers and insurers can now more accurately evaluate trigger data and forecast how acute their risk is of an intense dry period, wet harvest or even the potential for frost. This makes it particularly helpful for farmers in remote areas like much of the WA and NSW wheat belts.

For example, cover could be agreed at $1M based on there being more than 30 days of frost during winter (like many parts of NSW saw in 2018), and should that target be exceeded, the farmer would be paid out the $1M regardless of the damage suffered or the costs incurred to replant the crop. Cover could also even be implemented as little as 15 days out before harvest.

With extreme weather events causing up to 70% of crop loss in Australia, parametric insurance can give farmers added protection and greater confidence for their farming future.

Opportunity 2: a 2019 report by global firm Clyde & Co recommended implementing a risk management plan for the Great Barrier Reef in order to guarantee its long-term resilience against climate change and potential catastrophic events. Where there was previously no option for cover of the reef, parametric insurance can provide the $56B tourism asset with a security blanket, protecting it against any further coral bleaching, ocean acidification or pollution.

What are the benefits of parametric insurance?

Parametric insurance opens up a new avenue for risk coverage and can provide significant benefits to both insurer and customer.

It covers risks that traditional insurance can’t

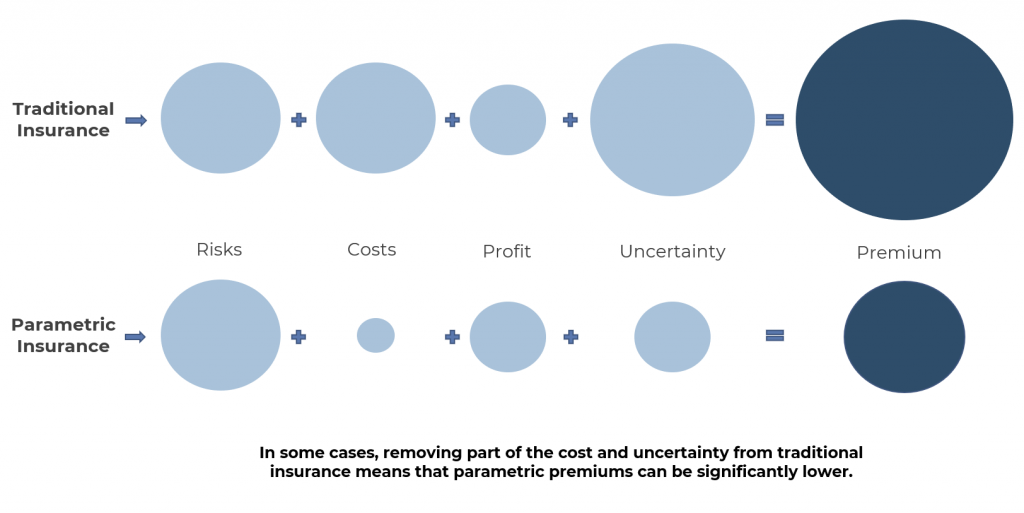

- People in areas hit by a catastrophic event in the past would find it very difficult to get cover on a traditional policy as the risk involved is simply too high. By insuring against the likelihood of an event happening as opposed to actual damage caused, parametric insurance reduces the cost and uncertainty for those who have previously been excluded.

It is able to service remote customers

- As parametric insurance relies on data to pay and assess claims, it becomes a lot easier for insurers to be able to assess and pay claims for those that live in remote areas. For example, a farmer’s crop can be covered based on agricultural indices such as crop yield, excessive temperatures or heavy rainfall.

It provides a transparent claims process

- Parametric insurance relies on a pre-agreed payout, so claims are processed quickly and efficiently. There is minimal paperwork required, no lengthy claims investigations and no disputes. With such a seamless process in place, it can also end up improving the overall customer and brand experience.

It’s becoming a valuable asset for brokers

- Parametric insurance adds another valuable tool to a broker’s tool box. It gives them the opportunity to fill the gaps left by a traditional insurance policy, or the option to provide a policy that couldn’t be placed previously. Brokers can ultimately provide clients with a policy that is all-encompassing, alleviating any uncertainty.

The future of parametric insurance

Although the market for parametric solutions in Australia is still in its infancy, its possibilities are only just being realised.

Advances in data science, sensor technology and artificial intelligence have enabled vastly superior data collection and analysis methods to be developed. Over time, this will allow insurers to evolve the modelling of data and indexes upon which payout triggers are based, price cover more accurately and provide a more bespoke selection of cover across a variety of industries.

With artificial intelligence at the forefront, the new generation of parametric insurance solutions could include protection for things like cities and airports in the event of terrorism, coverage for shipping and manufacturing companies when river water-levels fall, solutions for retailers in the event of reduced foot traffic during strikes, or economic assistance for hotels in the event of infectious disease outbreaks.

Just as many products and services have evolved by taking advantage of improvements in data science, parametric insurance cover looks to provide a more efficient insurance product that’s fitting for the modern age.