Why it’s important to correctly value your home & contents insurance to avoid being caught underinsured.

Key takeaways:

- Underinsurance is when you insure your home or contents for less than it’s worth – putting you at serious financial risk

- Regularly review the ‘sums insured’ of your property, especially if you expand/change locations or purchase new assets

- List your valuable ‘big ticket’ items separately on your policy

- Use a checklist to keep track of the value of your contents

- If you’ve renovated your home, remember to update your contents policy to reflect the extra things you now own

- Offset any increases to your annual premium by increasing your level of excess

Many Australians underestimate the value of their contents, particularly if they haven’t written down what they own or haven’t updated a contents inventory list for a while. It’s easy to forget to add new things you have purchased recently and gifts you have received.

New research from MCG Quantity Surveyors found that around 66% of Australian homes and businesses are underinsured.

Underinsurance refers to having insufficient insurance to cover the entire value of your home or contents in the event of a claim. In other words, being underinsured can put you, your household items, and your personal belongings at serious financial risk.

We’ve listed the 3 main ways that could lead you to being underinsured, along with a few tips on how best to avoid them.

1. Not calculating the replacement value of your contents correctly

If the value of your household possessions at the time of a loss is greater than the value you insured them for, you are underinsured by the difference in value. For example, if you insure your contents for $25,000 and you lose everything in a fire, but the total cost to replace them is $50,000, an insurer will never pay out more than the $25,000 sum insured.

Most contents policies also have limits on how much you can normally claim for certain ‘big-ticket’ items. For example, suppose $1,000 is the limit for jewellery, but you have a $10,000 engagement ring and choose not to tell the insurer about it. When it comes to making a claim, you’re going to end up $9,000 out of pocket.

- Engagement ring = $10,000

- Insurer’s limit for jewellery* = $1,000

- Out of pocket costs = $9,000

*when not specifically included as ‘listed cover’

So, for individual items worth more than what the insurer is willing to cover (e.g. engagement rings, collectibles, antiques), you will need to include them as 'specified' or 'listed cover' on your policy. Otherwise, you could find yourself getting paid out only a fraction of what those items are actually worth when you go to make a claim.

This Household Inventory Checklist is a great way to help you record and keep track of the value of your contents. It can also be an invaluable tool when deciding how much insurance coverage you need.

2. Estimating your contents correctly initially but forgetting to update your coverage as the value of your contents goes up

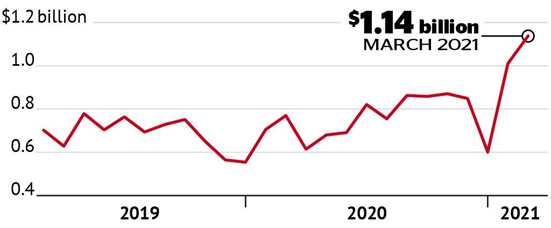

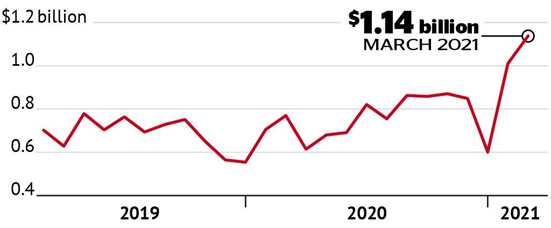

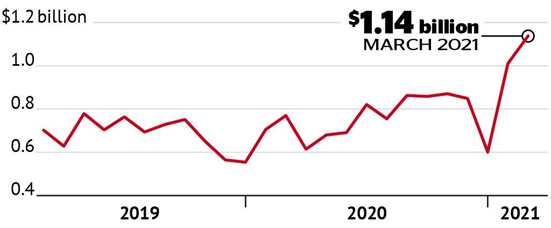

Throughout the pandemic, the number of people undertaking major home renovations hit an all-time high. In 2021, the value of renovations rose to $1.14 billion per month nationally. This is an increase of 68% compared to the monthly average seen in 2019.

Whether the renovation was for a swanky new office space, or a media room filled with the latest tech, it’s important that you update your contents policy to reflect the extra things you now own.

The same applies to power tools or gardening equipment. If you’ve added a shed and now have all kinds of power and gardening tools in there, you’ll need to add those to your contents policy to make sure they’re covered as well.

Source: NSW Government.

3. Customers intentionally looking to save on their premium

Listing valuable items – or any items that may increase in value over time – under your contents policy will inevitably increase the cost of your premium. This can often be a deterrent for customers. In this case, if an insured event occurs where you need to make a claim, the replacement costs will most likely outweigh any minor savings made on your premium.

So, instead of leaving your valuable items underinsured just to save on forking out a little extra on your premium, consider increasing the excess on your policy instead. Doing so can help bring your overall premium down as a higher excess usually means a lower annual premium.

If you need a hand with clarifying any of the wording in your policy’s Product Disclosure statement (PDS), or you just want the reassurance of knowing you and your belongings are properly covered, get in touch with us at Midland and one of our brokers would be happy to assist.

Sources: https://www.smh.com.au/national/nsw/renovation-nation-australians-spending-a-record-1-billion-a-month-on-their-homes-20210511-p57qwp.html; https://understandinsurance.com.au/calculators; https://www.choice.com.au/money/insurance/home-and-contents/articles/jewellery-insurance

Why it’s important to correctly value your home & contents insurance to avoid being caught underinsured.

Key takeaways:

- Underinsurance is when you insure your home or contents for less than it’s worth – putting you at serious financial risk

- Regularly review the ‘sums insured’ of your property, especially if you expand/change locations or purchase new assets

- List your valuable ‘big ticket’ items separately on your policy

- Use a checklist to keep track of the value of your contents

- If you’ve renovated your home, remember to update your contents policy to reflect the extra things you now own

- Offset any increases to your annual premium by increasing your level of excess

Many Australians underestimate the value of their contents, particularly if they haven’t written down what they own or haven’t updated a contents inventory list for a while. It’s easy to forget to add new things you have purchased recently and gifts you have received.

New research from MCG Quantity Surveyors found that around 66% of Australian homes and businesses are underinsured.

Underinsurance refers to having insufficient insurance to cover the entire value of your home or contents in the event of a claim. In other words, being underinsured can put you, your household items, and your personal belongings at serious financial risk.

We’ve listed the 3 main ways that could lead you to being underinsured, along with a few tips on how best to avoid them.

1. Not calculating the replacement value of your contents correctly

If the value of your household possessions at the time of a loss is greater than the value you insured them for, you are underinsured by the difference in value. For example, if you insure your contents for $25,000 and you lose everything in a fire, but the total cost to replace them is $50,000, an insurer will never pay out more than the $25,000 sum insured.

Most contents policies also have limits on how much you can normally claim for certain ‘big-ticket’ items. For example, suppose $1,000 is the limit for jewellery, but you have a $10,000 engagement ring and choose not to tell the insurer about it. When it comes to making a claim, you’re going to end up $9,000 out of pocket.

- Engagement ring = $10,000

- Insurer’s limit for jewellery* = $1,000

- Out of pocket costs = $9,000

*when not specifically included as ‘listed cover’

So, for individual items worth more than what the insurer is willing to cover (e.g. engagement rings, collectibles, antiques), you will need to include them as 'specified' or 'listed cover' on your policy. Otherwise, you could find yourself getting paid out only a fraction of what those items are actually worth when you go to make a claim.

This Household Inventory Checklist is a great way to help you record and keep track of the value of your contents. It can also be an invaluable tool when deciding how much insurance coverage you need.

2. Estimating your contents correctly initially but forgetting to update your coverage as the value of your contents goes up

Throughout the pandemic, the number of people undertaking major home renovations hit an all-time high. In 2021, the value of renovations rose to $1.14 billion per month nationally. This is an increase of 68% compared to the monthly average seen in 2019.

Whether the renovation was for a swanky new office space, or a media room filled with the latest tech, it’s important that you update your contents policy to reflect the extra things you now own.

The same applies to power tools or gardening equipment. If you’ve added a shed and now have all kinds of power and gardening tools in there, you’ll need to add those to your contents policy to make sure they’re covered as well.

Source: NSW Government.

3. Customers intentionally looking to save on their premium

Listing valuable items – or any items that may increase in value over time – under your contents policy will inevitably increase the cost of your premium. This can often be a deterrent for customers. In this case, if an insured event occurs where you need to make a claim, the replacement costs will most likely outweigh any minor savings made on your premium.

So, instead of leaving your valuable items underinsured just to save on forking out a little extra on your premium, consider increasing the excess on your policy instead. Doing so can help bring your overall premium down as a higher excess usually means a lower annual premium.

If you need a hand with clarifying any of the wording in your policy’s Product Disclosure statement (PDS), or you just want the reassurance of knowing you and your belongings are properly covered, get in touch with us at Midland and one of our brokers would be happy to assist.

Sources: https://www.smh.com.au/national/nsw/renovation-nation-australians-spending-a-record-1-billion-a-month-on-their-homes-20210511-p57qwp.html; https://understandinsurance.com.au/calculators; https://www.choice.com.au/money/insurance/home-and-contents/articles/jewellery-insurance