Key takeaways:

Film production insurance is crucial in filmmaking, particularly when considering the number of people that are on-set and the myriad of tasks that need to be done. A good film insurance policy protects the producers, filmmakers, film crew, production gear and all the filming locations from liability claims.

And with the recently announced $400M in cash grants by the Aus. government to help lure more overseas film & TV productions to Australia, now would be an ideal time to revisit your existing insurance policy (or to set up a new one).

Below is your guide to everything you need to know about film production insurance and how a broker can help ensure you are covered correctly.

WHAT IS FILM PRODUCTION INSURANCE?

Film production insurance protects your production company and/or project from related liability. Since no two projects are alike, a good film production insurance policy is tailored to a production company’s specific needs.

A production insurance policy can either cover an individual project (short-term), or can be tailored for the business as an annual policy (long-term).

As a producer, you carry a large responsibility if something goes wrong. A good insurance policy can protect you from the following:

Liability related to injuries on set

Theft and ‘loss and damage’ of rented and owned equipment

Libel or copyright infringement claims

Business interruption

PROJECT BASED (SHORT-TERM) vs. ANNUAL (LONG-TERM) PRODUCTION INSURANCE.

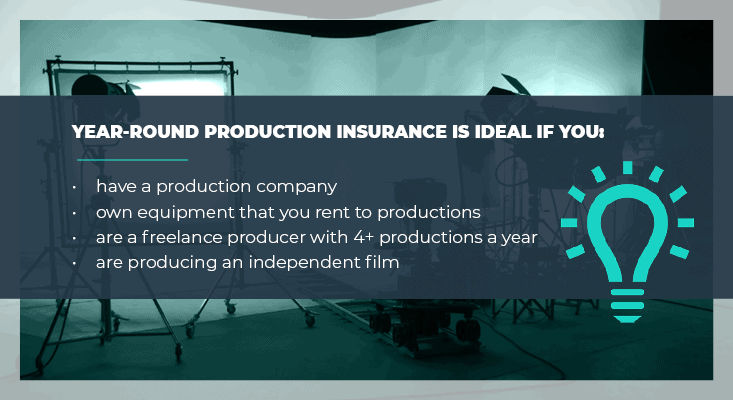

Although production insurance is available on a project-by-project basis, if you are planning to shoot multiple times throughout the year, an annual policy is likely to be the most effective.

You will often find that the difference in price is nominal when considering the longer period covered. But it's wise to get a quote on both so you can compare for yourself.

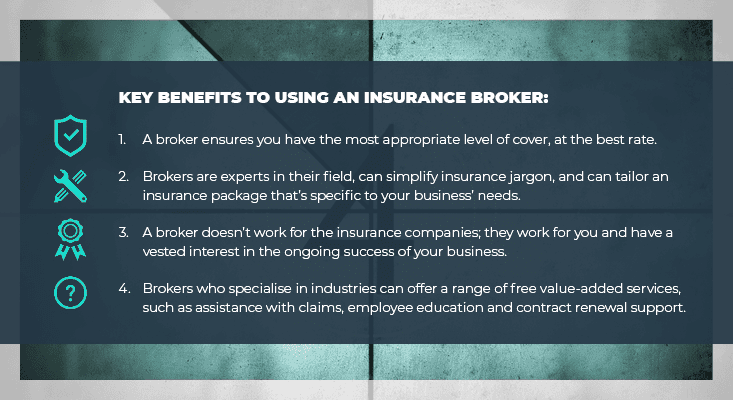

Price-conscious business owners usually believe it is more cost effective going direct to the insurance provider. However, this is often not the case, particularly with the various facets that need to be considered in operating a business these days.

WHAT YOU NEED TO KNOW ABOUT HIRING AN INSURANCE BROKER.

Make sure you provide all details of your production to your broker. It's important that you tell your broker how your production company functions and what kind of project you're producing. This will ensure you are properly covered for your specific filming activities.

When talking with your broker, don't spare the details about the type of project you're producing (e.g. location type, working with animals, explosives, weapons or vehicles etc), because nothing is worse than having a serious issue on-set that could have been covered by your policy… but isn’t.

Our brokers have worked alongside many film and television producers to insure some of Australia’s best known productions. So whether you're working on a commercial, full-length TV series or movie, music video or corporate video, we can make sure you are covered, all the way from script to screen.