STATE OF THE MARKET UPDATE - A Hardening Insurance Market & Rising Premiums - June 2021

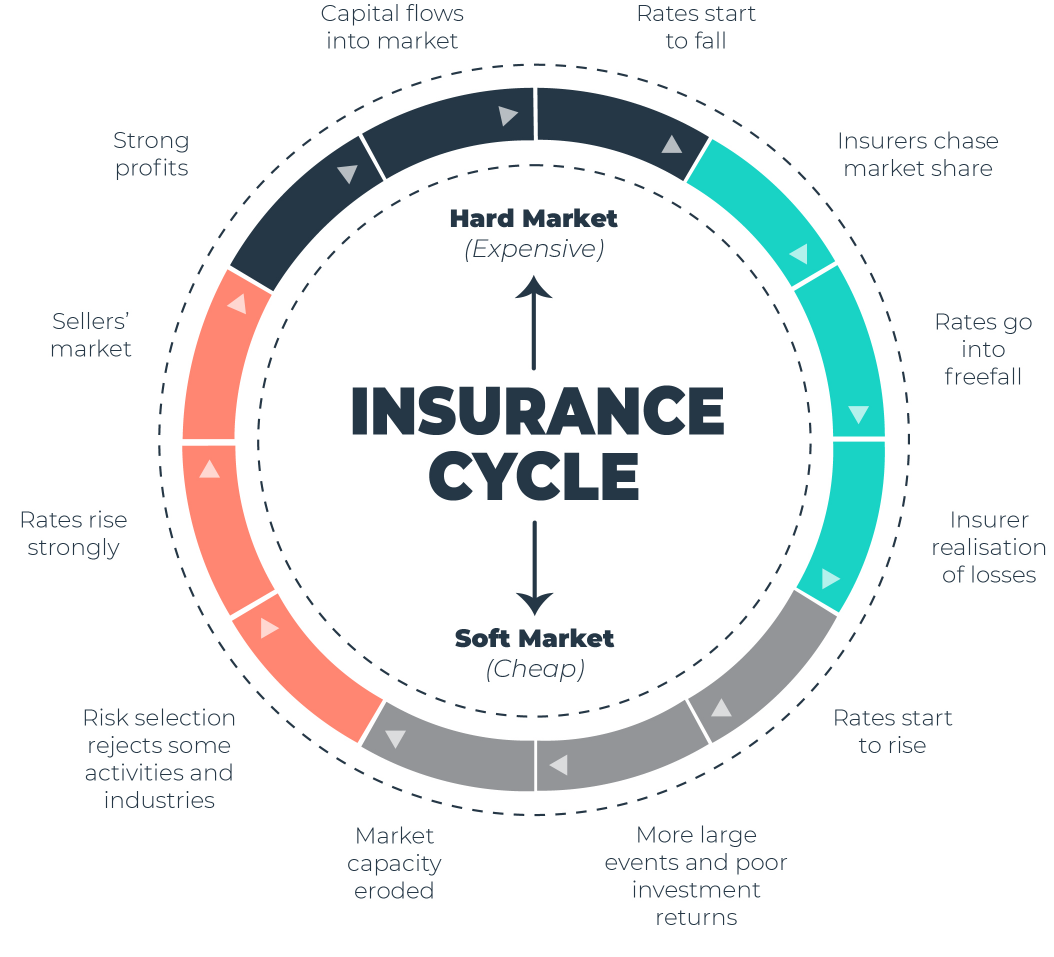

All industries experience cycles of expansion and contraction, and this is particularly true of the insurance industry. Although no two cycles are exactly the same, insurance industry cycles typically last between three to ten years and incorporate phases marked by an expansion (hard market) and a contraction (soft market) of insurance availability.

Today, Australia is well into a hard market across most insurance lines effecting the majority of industries.

The most recent Marsh ‘Global Insurance Market Index’ report found that Australia’s commercial insurance pricing increased 35% in the fourth quarter of 2020, while financial and professional lines rose a whopping 51%. Both lines have been continuing an upward trend that began in the first quarter of 2017.

This suggests that the insurance industry is currently hovering around 10-11 o’clock on the insurance clock pictured above, with insurance experts predicting that the hard market will continue into 2021/2022, further exacerbated by COVID-19 and other issues.

What is a soft market vs. a hard market?

In a soft market, insurance companies have a broader appetite for “risk”, greater underwriting flexibility, and compete with one another by (generally) lowering premiums to attract more customers.

This is a period of time when insurance companies have high-dollar reserves and can make money in the stock market. Thus, they can lower their premiums to a point where they either don’t make money or even lose money on the “underwriting” side of the equation.

The characteristics of a soft market typically include:

- lower insurance premiums

- broader coverage

- relaxed underwriting criteria, which means underwriting is easier

- increased capacity, meaning insurance carriers write more policies and higher limits

- increased competition among insurance carriers

Alternatively, a hard market is when there is a high demand for insurance, but a lower supply of coverage available. The primary impact on customers is a rise in the price of insurance, and sometimes insurers reduce or stop providing cover for certain types of risk altogether.

The characteristics of a hard market typically include:

- higher insurance premiums

- low interest rates

- an increase in the frequency or severity of losses

- more stringent underwriting guidelines, making it more difficult to find options for insurance

- fewer insurers writing certain coverage lines and specific industries

- diminished capacity, meaning there are fewer insurers writing certain coverage lines and specific industries

- less competition among insurance carriers

Why are we currently facing a hard market?

The last few years has seen Australia gradually move towards a hard market; however it was 2020 where we saw insurance profitability take the biggest hit.

2020 reported only $35m in profit for the calendar year, which was a staggering 98.9% decrease on the $3.1bn reported in 2019. This profit loss was largely driven by natural catastrophe claims costs, provisions for business interruption claims, a large strengthening of long-tail claims reserves (long-term, large payout settlements), and falls in investment income.

Below is a little more detail behind the key contributing factors that have played a role in Australia’s transition from a soft insurance market to a hard insurance market over the last few years.

Increases in the frequency or severity of losses (natural catastrophes)

The Australian market suffered heavy catastrophe losses in 2020, shaken by bushfires, cyclones, floods and hailstorms which raged across much of Australia’s eastern seaboard and resulted in immense financial costs for the insurance industry. Insurers that have paid large claims for certain risks may be reluctant or unwilling to insure those risks in the future

The 2019-2020 “Black Summer” bushfires alone were unprecedented in terms of scale and damage. The impact of the bushfires resulted in over 30,000 claims, resulting in insurers paying out a total of $2.4bn. This was the most expensive claims payout since the devastating floods and Cyclone Yasi hit QLD in 2011, with insurance losses totalling over $4.5bn.

Insurers that have paid large claims for certain risks may be reluctant or unwilling to insure those risks in the future

Falling investment returns for insurers

Investment income fell by almost 50% during the year due to lower returns in equities, fixed interest investments and indirect investments, particularly during the COVID-19 impacted March 2020 quarter.

The COVID-related global economic downturn has caused interest rates to hover near zero %, decimating the investment return income which insurers have traditionally relied upon as an integral source of profit.

COVID-19 has exacerbated and extended the hard market conditions with significant losses in Directors & Officers Liability (D&O), Employment Practices Liability Insurance (EPLI), Event Cancellation and other lines.

Social inflation

Social inflation is the societal trend towards increased litigation, plaintiff-friendly legal decisions, and larger jury awards – all of which put pressure on insurer performance.

The average number of securities class action claims lodged per year in Australia has risen by 300% since 2011. Big banks and financial services firms also continue to face a litigious 12 months as last year's Hayne royal commission hearings inspire regulators, consumers and shareholders to take them to court.

The surge in shareholder class actions has notably made its mark on the Directors and Officers Liability (D&O) insurance market. The future of the D&O market hangs in the balance as availability dwindles and costs surge for D&O insurance products.

Rising cost of reinsurance

Reinsurance is the insurance that insurance companies purchase to protect their bottom line. Recent times have seen the cost of reinsurance increasing due to the large number of catastrophe losses around the world.

Typically, the reinsurance market drives insurance pricing trends. If reinsurers increase their costs significantly, insurers react by passing down their primary premium to the consumer. It’s only natural that as one rises, so does the other.

Australian agreements on reinsurance pricing for the first half of 2020 saw increases in the range of 10% to 20%.

How to Survive a Hard Market

Here are some high-level recommendations you can adopt today to help you mitigate hard market impacts on your insurance spend.

1. Plan ahead

Stay ahead of your renewal process and communicate early with your broker to help you identify how you will be impacted by the increased cost of insurance.

2. Be prepared to provide more detail at the time of renewal

Due to increased underwriting scrutiny, you may be required to submit additional applications.

3. Partner with a specialised and trustworthy broker

With shrinking capacity, insurers will be scrutinising the number of brokers and wholesalers with whom they work. Be sure to work with a broker with strong insurer relationships and knowledge of your industry.

4. Don't wait until renewal to review your policies and procedures

Maintain communication with your broker during your policy period – not just during the renewal process – to understand where improvements can be made.

5. Update your integrated risk management programs and procedures

Be prepared to explain your claims and what measures you took to mitigate this exposure.

The bottom line

Even before the coronavirus crisis hit, the insurance industry was in a period of significant rate hardening.

Insurers are relying upon premium adequacy to cover losses and generate profits by increasing rates, refining their risk appetite, reducing the capacity they are willing to offer, sharpening their underwriting, and incorporating restrictive language in their policies.

This insurance trend is most likely to continue over the next two years, or even longer, so consumers should budget appropriately and work closely with their brokers to evaluate the efficacy of their risk management strategy.

The key is to take proactive steps now to save you in the future.

We’re here to help. If you’d like to get more advice on the current 'hard market' and how it might impact your business or insurance premiums, please contact us.

Sources: Marsh Global Insurance Quarterly Report Q4 2020; InsuranceBusinessMag.com, InsuranceCouncil.com.au, APRA.gov.au; canstar.com.au/home-insurance/natural-disasters-australia/; Allens, Shareholder Class Actions in Australia, February 2017; www.afr.com/companies/financial-services/banks-face-a-litigious-year-posthayne-royal-commission-20190110-h19wpy; https://www.insurancejournal.com/news/international/2020/09/09/581794.htm;

STATE OF THE MARKET UPDATE - A Hardening Insurance Market & Rising Premiums - June 2021

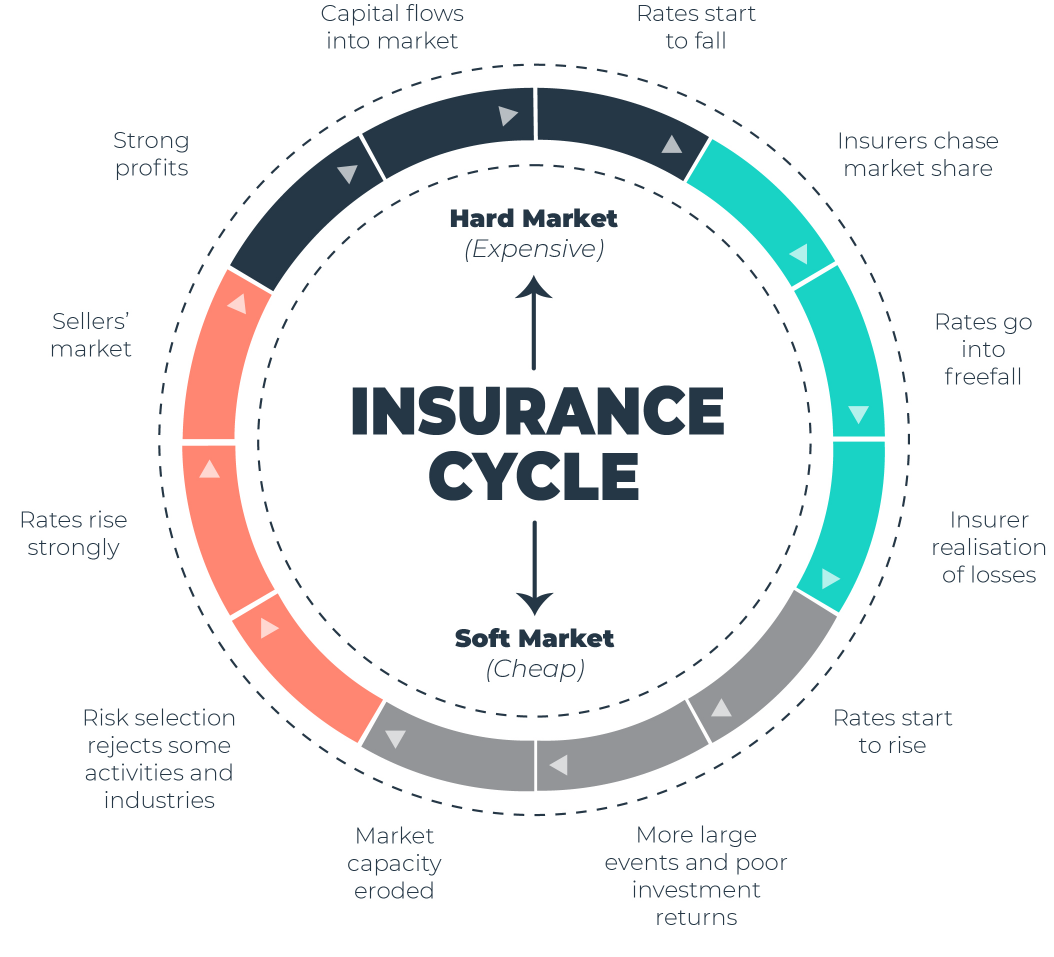

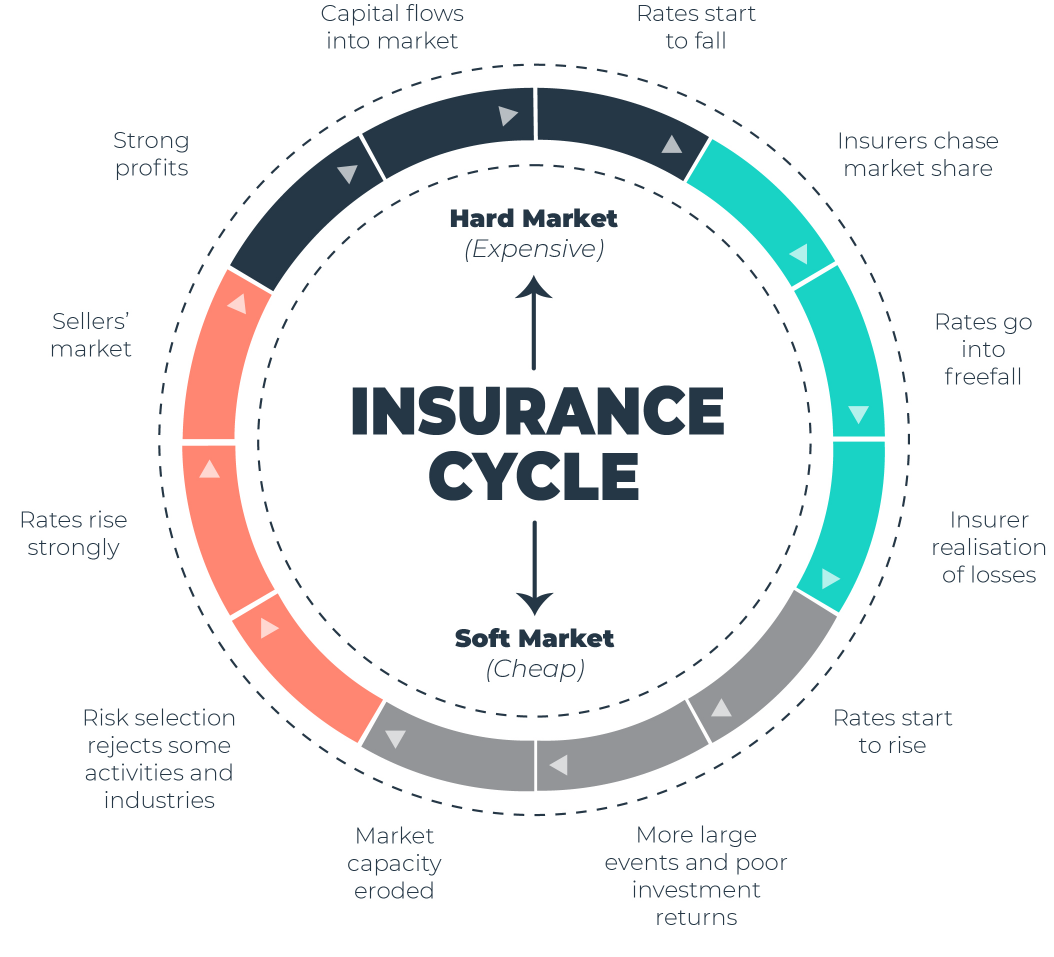

All industries experience cycles of expansion and contraction, and this is particularly true of the insurance industry. Although no two cycles are exactly the same, insurance industry cycles typically last between three to ten years and incorporate phases marked by an expansion (hard market) and a contraction (soft market) of insurance availability.

Today, Australia is well into a hard market across most insurance lines effecting the majority of industries.

The most recent Marsh ‘Global Insurance Market Index’ report found that Australia’s commercial insurance pricing increased 35% in the fourth quarter of 2020, while financial and professional lines rose a whopping 51%. Both lines have been continuing an upward trend that began in the first quarter of 2017.

This suggests that the insurance industry is currently hovering around 10-11 o’clock on the insurance clock pictured above, with insurance experts predicting that the hard market will continue into 2021/2022, further exacerbated by COVID-19 and other issues.

What is a soft market vs. a hard market?

In a soft market, insurance companies have a broader appetite for “risk”, greater underwriting flexibility, and compete with one another by (generally) lowering premiums to attract more customers.

This is a period of time when insurance companies have high-dollar reserves and can make money in the stock market. Thus, they can lower their premiums to a point where they either don’t make money or even lose money on the “underwriting” side of the equation.

The characteristics of a soft market typically include:

- lower insurance premiums

- broader coverage

- relaxed underwriting criteria, which means underwriting is easier

- increased capacity, meaning insurance carriers write more policies and higher limits

- increased competition among insurance carriers

Alternatively, a hard market is when there is a high demand for insurance, but a lower supply of coverage available. The primary impact on customers is a rise in the price of insurance, and sometimes insurers reduce or stop providing cover for certain types of risk altogether.

The characteristics of a hard market typically include:

- higher insurance premiums

- low interest rates

- an increase in the frequency or severity of losses

- more stringent underwriting guidelines, making it more difficult to find options for insurance

- fewer insurers writing certain coverage lines and specific industries

- diminished capacity, meaning there are fewer insurers writing certain coverage lines and specific industries

- less competition among insurance carriers

Why are we currently facing a hard market?

The last few years has seen Australia gradually move towards a hard market; however it was 2020 where we saw insurance profitability take the biggest hit.

2020 reported only $35m in profit for the calendar year, which was a staggering 98.9% decrease on the $3.1bn reported in 2019. This profit loss was largely driven by natural catastrophe claims costs, provisions for business interruption claims, a large strengthening of long-tail claims reserves (long-term, large payout settlements), and falls in investment income.

Below is a little more detail behind the key contributing factors that have played a role in Australia’s transition from a soft insurance market to a hard insurance market over the last few years.

Increases in the frequency or severity of losses (natural catastrophes)

The Australian market suffered heavy catastrophe losses in 2020, shaken by bushfires, cyclones, floods and hailstorms which raged across much of Australia’s eastern seaboard and resulted in immense financial costs for the insurance industry. Insurers that have paid large claims for certain risks may be reluctant or unwilling to insure those risks in the future

The 2019-2020 “Black Summer” bushfires alone were unprecedented in terms of scale and damage. The impact of the bushfires resulted in over 30,000 claims, resulting in insurers paying out a total of $2.4bn. This was the most expensive claims payout since the devastating floods and Cyclone Yasi hit QLD in 2011, with insurance losses totalling over $4.5bn.

Insurers that have paid large claims for certain risks may be reluctant or unwilling to insure those risks in the future

Falling investment returns for insurers

Investment income fell by almost 50% during the year due to lower returns in equities, fixed interest investments and indirect investments, particularly during the COVID-19 impacted March 2020 quarter.

The COVID-related global economic downturn has caused interest rates to hover near zero %, decimating the investment return income which insurers have traditionally relied upon as an integral source of profit.

COVID-19 has exacerbated and extended the hard market conditions with significant losses in Directors & Officers Liability (D&O), Employment Practices Liability Insurance (EPLI), Event Cancellation and other lines.

Social inflation

Social inflation is the societal trend towards increased litigation, plaintiff-friendly legal decisions, and larger jury awards – all of which put pressure on insurer performance.

The average number of securities class action claims lodged per year in Australia has risen by 300% since 2011. Big banks and financial services firms also continue to face a litigious 12 months as last year's Hayne royal commission hearings inspire regulators, consumers and shareholders to take them to court.

The surge in shareholder class actions has notably made its mark on the Directors and Officers Liability (D&O) insurance market. The future of the D&O market hangs in the balance as availability dwindles and costs surge for D&O insurance products.

Rising cost of reinsurance

Reinsurance is the insurance that insurance companies purchase to protect their bottom line. Recent times have seen the cost of reinsurance increasing due to the large number of catastrophe losses around the world.

Typically, the reinsurance market drives insurance pricing trends. If reinsurers increase their costs significantly, insurers react by passing down their primary premium to the consumer. It’s only natural that as one rises, so does the other.

Australian agreements on reinsurance pricing for the first half of 2020 saw increases in the range of 10% to 20%.

How to Survive a Hard Market

Here are some high-level recommendations you can adopt today to help you mitigate hard market impacts on your insurance spend.

1. Plan ahead

Stay ahead of your renewal process and communicate early with your broker to help you identify how you will be impacted by the increased cost of insurance.

2. Be prepared to provide more detail at the time of renewal

Due to increased underwriting scrutiny, you may be required to submit additional applications.

3. Partner with a specialised and trustworthy broker

With shrinking capacity, insurers will be scrutinising the number of brokers and wholesalers with whom they work. Be sure to work with a broker with strong insurer relationships and knowledge of your industry.

4. Don't wait until renewal to review your policies and procedures

Maintain communication with your broker during your policy period – not just during the renewal process – to understand where improvements can be made.

5. Update your integrated risk management programs and procedures

Be prepared to explain your claims and what measures you took to mitigate this exposure.

The bottom line

Even before the coronavirus crisis hit, the insurance industry was in a period of significant rate hardening.

Insurers are relying upon premium adequacy to cover losses and generate profits by increasing rates, refining their risk appetite, reducing the capacity they are willing to offer, sharpening their underwriting, and incorporating restrictive language in their policies.

This insurance trend is most likely to continue over the next two years, or even longer, so consumers should budget appropriately and work closely with their brokers to evaluate the efficacy of their risk management strategy.

The key is to take proactive steps now to save you in the future.

We’re here to help. If you’d like to get more advice on the current 'hard market' and how it might impact your business or insurance premiums, please contact us.

Sources: Marsh Global Insurance Quarterly Report Q4 2020; InsuranceBusinessMag.com, InsuranceCouncil.com.au, APRA.gov.au; canstar.com.au/home-insurance/natural-disasters-australia/; Allens, Shareholder Class Actions in Australia, February 2017; www.afr.com/companies/financial-services/banks-face-a-litigious-year-posthayne-royal-commission-20190110-h19wpy; https://www.insurancejournal.com/news/international/2020/09/09/581794.htm;