Autonomous vehicles (AVs) are no longer just something out of science fiction. In Australia, major steps are being taken toward making self-driving cars a reality. But as cars start to drive themselves, what will happen to car insurance?<br />

Big changes are coming, and they won’t be simple. Insurance companies, car manufacturers, and policymakers all need to rethink how risks are assessed, who is responsible for accidents, and how insurance products should evolve to meet new challenges.

The Changing Face of Risk and Liability

Traditionally, automotive insurance in Australia primarily addresses human error, a leading cause of road incidents. However, AV technology promises reduced collisions through advanced sensors, artificial intelligence, and automated decision-making processes.

According to the National Transport Commission (NTC), human error contributes to over 90% of crashes in Australia. Autonomous vehicles, with their promise of eliminating driver error, could dramatically reduce this statistic.

Insurance companies must proactively adapt their products and business models. Liability will increasingly transfer from drivers to manufacturers and technology providers

— Motor Trades Association of QLD

Will Insurance Get Cheaper?

As accident rates drop, personal motor insurance premiums could decrease significantly. Global consulting firm McKinsey predicts that by 2040, motor insurance premiums could decline by up to 40% due to widespread AV adoption. However, the insurance industry's overall revenue might remain steady, as product liability insurance for manufacturers and cybersecurity coverage will likely increase. Additionally, insurers may diversify by offering specialised AV maintenance and repair coverage, sensor and software failure protection, and usage-based insurance models tailored to semi-autonomous and fully autonomous vehicles.

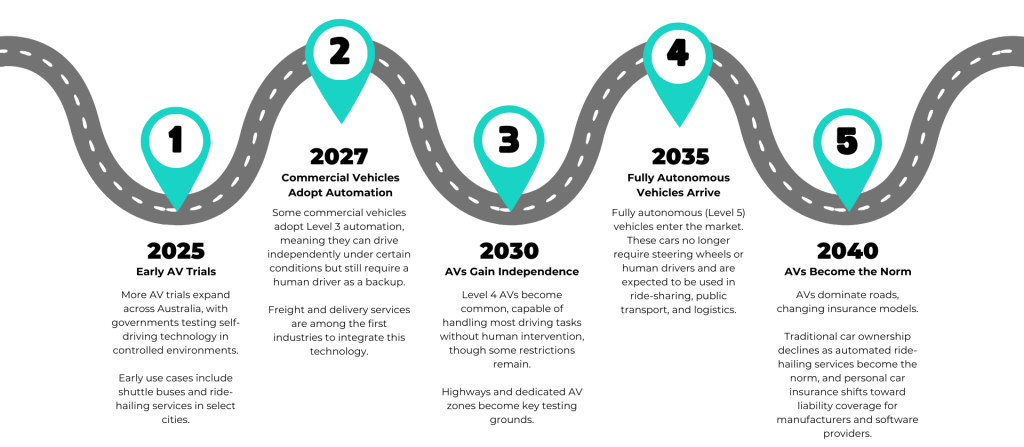

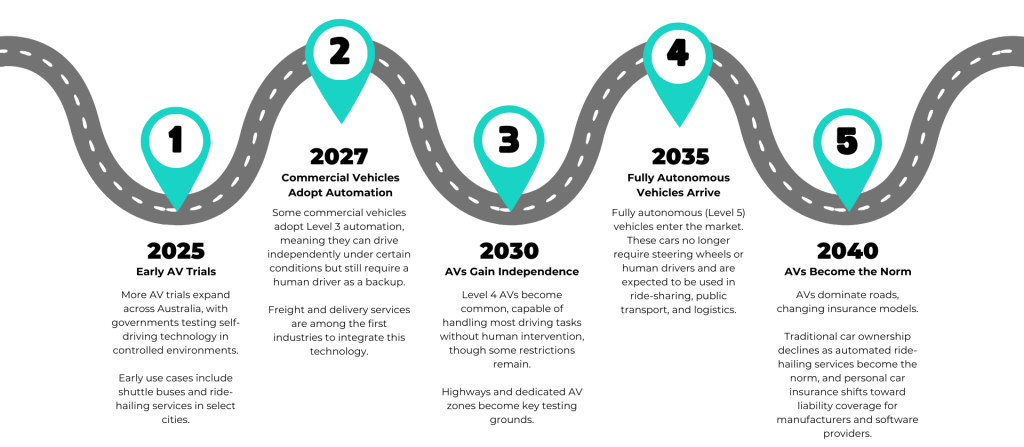

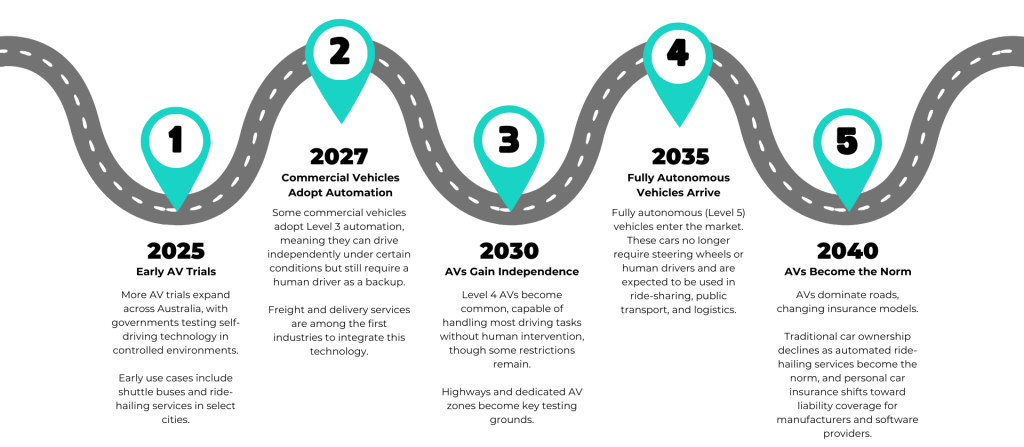

The Road to Self-Driving Cars. Where Are We Now?

While we don’t have fully self-driving cars on our roads yet, things are moving forward. Here’s what to expect in the coming years:

New Types of Insurance

As autonomous vehicles become more common, we’re likely to see the rise of new insurance products designed to meet emerging risks. These may include:

1. Cybersecurity Insurance – Addressing risks related to hacking, data breaches, and system vulnerabilities.

2. Product Liability Insurance – Covering manufacturers and software companies in case their technology fails, which could shift the financial burden of accidents away from individual drivers.

3. Sensor & Software Failure Insurance – Providing coverage for AV-specific technology malfunctions that could lead to accidents.

4. Usage-Based Insurance (UBI) – As more people use AV ride-sharing instead of owning cars, insurance may shift to a usage-based model where users pay only for the time they spend in an AV.

5. Fleet Insurance for AV Operators – Companies that run AV fleets, such as ride-hailing services and delivery networks, will need large-scale, tailored policies to cover potential risks.

Did You Know

By 2050, it's estimated that autonomous vehicles could reduce road fatalities by up to 90% worldwide, potentially saving millions of lives and billions in associated economic costs.

Challenges on the Road Ahead

Before AVs take over completely, we need to solve some big challenges. Australia’s laws, road infrastructure, and public trust all need to adapt. Governments will need to introduce clear policies regarding liability, cybersecurity standards, and road-sharing between AVs and human drivers. Additionally, insurers will need to collect and analyse data from AV trials to understand risk factors better.

One major concern is public acceptance. While AVs have been proven to drive more safely than humans in controlled tests, many Australians remain hesitant to trust their safety to a computer. Surveys suggest that trust in AV technology will be a key factor in its adoption rate.

Another issue is infrastructure. Australia’s roads, traffic signals, and GPS systems will need upgrades to communicate effectively with AVs. This means significant investment from both the government and private sector to make cities “AV-friendly.”

The Bottom Line

For Australian insurance providers, proactively embracing AV technology is crucial. Investing in expertise around AI technology, cybersecurity, and product liability will be essential for insurers seeking long-term sustainability.

Collaboration between policymakers, technology providers, and insurers is vital to ensure a smooth transition, maximising AVs' societal benefits while effectively managing emerging risks. Insurers should begin by investing in research, upskilling their teams in emerging technologies, and actively participating in policy discussions. Regulators, in turn, must provide clear legal frameworks and incentives that encourage innovation while maintaining public safety and accountability.

Autonomous vehicles represent a major step forward in transportation safety and efficiency, but this shift requires insurers to redefine their strategies fundamentally. Ultimately, the future belongs to those who adapt quickest to this inevitable technological evolution.

To learn how Midland can help your business prepare for the future of autonomous vehicles, contact us today.

Written By Damien Lane

Director at Midland

Damien specialises in providing tailored insurance solutions for Australian businesses, with a particular expertise in the brewery and distillery sectors.

Autonomous vehicles (AVs) are no longer just something out of science fiction. In Australia, major steps are being taken toward making self-driving cars a reality. But as cars start to drive themselves, what will happen to car insurance?<br />

Big changes are coming, and they won’t be simple. Insurance companies, car manufacturers, and policymakers all need to rethink how risks are assessed, who is responsible for accidents, and how insurance products should evolve to meet new challenges.

The Changing Face of Risk and Liability

Traditionally, automotive insurance in Australia primarily addresses human error, a leading cause of road incidents. However, AV technology promises reduced collisions through advanced sensors, artificial intelligence, and automated decision-making processes.

According to the National Transport Commission (NTC), human error contributes to over 90% of crashes in Australia. Autonomous vehicles, with their promise of eliminating driver error, could dramatically reduce this statistic.

Insurance companies must proactively adapt their products and business models. Liability will increasingly transfer from drivers to manufacturers and technology providers

— Motor Trades Association of QLD

Will Insurance Get Cheaper?

As accident rates drop, personal motor insurance premiums could decrease significantly. Global consulting firm McKinsey predicts that by 2040, motor insurance premiums could decline by up to 40% due to widespread AV adoption. However, the insurance industry's overall revenue might remain steady, as product liability insurance for manufacturers and cybersecurity coverage will likely increase. Additionally, insurers may diversify by offering specialised AV maintenance and repair coverage, sensor and software failure protection, and usage-based insurance models tailored to semi-autonomous and fully autonomous vehicles.

The Road to Self-Driving Cars. Where Are We Now?

While we don’t have fully self-driving cars on our roads yet, things are moving forward. Here’s what to expect in the coming years:

New Types of Insurance

As autonomous vehicles become more common, we’re likely to see the rise of new insurance products designed to meet emerging risks. These may include:

1. Cybersecurity Insurance – Addressing risks related to hacking, data breaches, and system vulnerabilities.

2. Product Liability Insurance – Covering manufacturers and software companies in case their technology fails, which could shift the financial burden of accidents away from individual drivers.

3. Sensor & Software Failure Insurance – Providing coverage for AV-specific technology malfunctions that could lead to accidents.

4. Usage-Based Insurance (UBI) – As more people use AV ride-sharing instead of owning cars, insurance may shift to a usage-based model where users pay only for the time they spend in an AV.

5. Fleet Insurance for AV Operators – Companies that run AV fleets, such as ride-hailing services and delivery networks, will need large-scale, tailored policies to cover potential risks.

Did You Know

By 2050, it's estimated that autonomous vehicles could reduce road fatalities by up to 90% worldwide, potentially saving millions of lives and billions in associated economic costs.

Challenges on the Road Ahead

Before AVs take over completely, we need to solve some big challenges. Australia’s laws, road infrastructure, and public trust all need to adapt. Governments will need to introduce clear policies regarding liability, cybersecurity standards, and road-sharing between AVs and human drivers. Additionally, insurers will need to collect and analyse data from AV trials to understand risk factors better.

One major concern is public acceptance. While AVs have been proven to drive more safely than humans in controlled tests, many Australians remain hesitant to trust their safety to a computer. Surveys suggest that trust in AV technology will be a key factor in its adoption rate.

Another issue is infrastructure. Australia’s roads, traffic signals, and GPS systems will need upgrades to communicate effectively with AVs. This means significant investment from both the government and private sector to make cities “AV-friendly.”

The Bottom Line

For Australian insurance providers, proactively embracing AV technology is crucial. Investing in expertise around AI technology, cybersecurity, and product liability will be essential for insurers seeking long-term sustainability.

Collaboration between policymakers, technology providers, and insurers is vital to ensure a smooth transition, maximising AVs' societal benefits while effectively managing emerging risks. Insurers should begin by investing in research, upskilling their teams in emerging technologies, and actively participating in policy discussions. Regulators, in turn, must provide clear legal frameworks and incentives that encourage innovation while maintaining public safety and accountability.

Autonomous vehicles represent a major step forward in transportation safety and efficiency, but this shift requires insurers to redefine their strategies fundamentally. Ultimately, the future belongs to those who adapt quickest to this inevitable technological evolution.

To learn how Midland can help your business prepare for the future of autonomous vehicles, contact us today.

Written By Damien Lane

Director at Midland

Damien specialises in providing tailored insurance solutions for Australian businesses, with a particular expertise in the brewery and distillery sectors.