Thinking of building or renovating? Here's what you need to know about builders warranty.

What Is Included in a Builders Warranty?

A builder’s warranty is essential protection for homeowners, shielding them from defects in new builds or renovations. In Australia, this warranty typically covers major structural issues for up to six years and non-structural defects for two years. It also provides protection if a builder becomes insolvent, dies, or disappears. However, cosmetic defects or maintenance-related problems are generally excluded.

Builders Warranty Coverage

Builders warranties mainly cover significant structural issues, such as foundation failures, subsidence, or roof leaks, with protection typically lasting for six years. Additionally, non-structural defects like plumbing problems or poor-quality finishes are usually covered for two years. If a builder fails to complete a project due to insolvency or another reason, the warranty can help the homeowner recover financially.

Whether you're building a home or renovating, the builder's warranty offers crucial protection. In Victoria, for instance, any building work exceeding $16,000 must be covered by builders warranty insurance.

— Victoria Domestic Building Contracts Act 1995Recent Developments in Australia

Several builder collapses, like the recent failure of Porter Davis, have highlighted the importance of builders warranty insurance. This has led to reforms, especially in Victoria, where builders are now required to register their insurance details before starting any work. Similarly, the New South Wales government is reviewing its builders warranty system to make claims more transparent and accessible.

State-Specific Variations

Builders warranty regulations differ across Australia. In New South Wales, for example, the warranty is mandatory for any residential building work over $20,000. However, in Tasmania and the Northern Territory, builders warranty insurance is not required by law, leaving homeowners with less protection (A New House).

Making a Claim on Builders Warranty

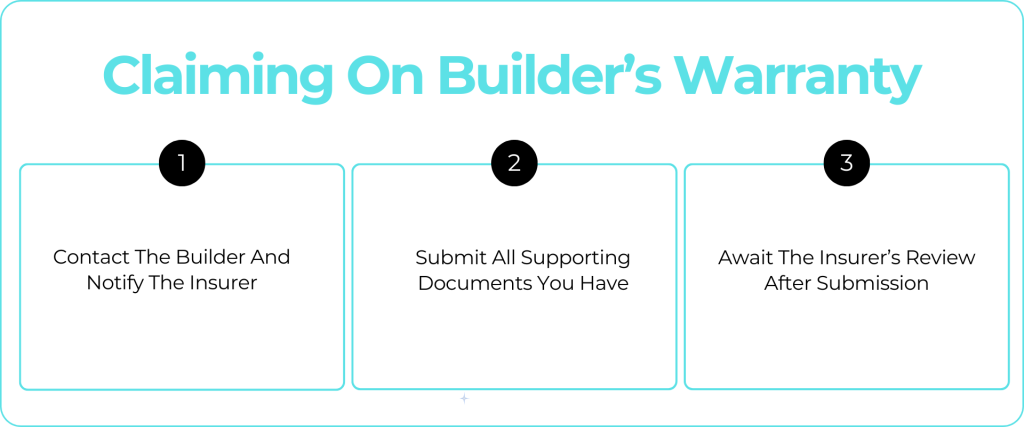

If you encounter defects or incomplete work, follow these steps to claim your builders warranty:

- Contact the builder: Initially, ask the builder to fix the issue.

- Notify the insurer: If the builder cannot resolve the issue, contact the insurer.

- Submit supporting documents: Evidence like photos, contracts, or inspection reports will help substantiate your claim.

- Insurer review: The insurer may conduct further inspections before approving compensation for fixing the defect or completing the work.

Exclusions

Not all issues are covered. For instance, cosmetic problems such as paint scratches, general wear and tear, and any maintenance failures on the part of the homeowner are typically excluded (A New House). Furthermore, any changes made after completion, like renovations, may not be covered under the original builders warranty.

References

- Victoria Domestic Building Contracts Act 1995: This act mandates builders warranty insurance for projects over $16,000.

- Porter Davis Collapse and Reforms: Coverage of the builder collapse and its implications for builders warranty reforms in Victoria and NSW.

- State-Specific Builders Warranty Laws: A detailed look at the differing builders warranty requirements across Australian states.

- Steps to Make a Claim: Guidance on how to file a claim under builders warranty insurance.